-

-

Fidelium - A reliable partner.

-

Reliable partnership. Operational engagement. Long-term capital.

-

-

Fidelium is an experienced partner for companies seeking a long-term operational investor. Whatever the challenge, our approach is always responsible, pragmatic, and dependable. We also benefit from short decision-making paths and a culture of open communication.

-

We specialize in majority holdings in:

-

Our core business involves companies that are profitable but offer room for improvement through targeted operational measures. We aim to work with management to address the various challenges and help the organization to achieve a new and sustained level of competitiveness.

-

Fidelium has many years of experience with corporate carve-outs, helping business units to become successful independent companies. We have a wealth of insight into the challenges and complexities of this type of investment. Our proven strategy is to focus on non-core assets and provide them with both capital investment and active hands-on support.

-

We invest in special situations, such as succession scenarios, management buy-outs/buy-ins, and turnarounds. Our goal in each case is to implement the long-term changes required to secure future viability. We also seek to act in a fair and proportionate manner toward all parties.

Operational engagement is the strongest form of commitment.

Fidelium is an operational investor. Unlike most financial investors, we look for companies that are currently facing significant operational challenges. Growth and stable cash flows are our goal, but rarely in place already. Our objective is to improve the business and secure its long-term growth.

To achieve this, we work closely with the management teams, providing active operational support. Rather than periodic monitoring or occasional appearances on an advisory board, we draw on our long experience to provide hands-on assistance with specific issues. We also act as a sounding board for new ideas on strategy and business development. We offer particular expertise in the areas of sales and financing, efficiency enhancement, and the implementation of buy-and-build strategies. Our role also often involves providing active support for the carve-out of business units and their subsequent transformation into independent SMEs.

Long-term capital offers companies the best prospects.

Fidelium manages a major equity fund backed by a number of German business families. Long-term assets totaling EUR 103 million are available for acquisitions, follow-on investments, and add-ons. The Fidelium team members also invest significant amounts of their own money.

This enables us to finance transactions without bank borrowing. As a result, our portfolio companies are not loaded up with additional debt. This is particularly important in challenging situations, where speed, flexibility, and transaction reliability are vital.

The Fidelium Group is based entirely in Germany and registered with the German Federal Financial Supervisory Authority (BaFin) as an external capital management company in accordance with Section 44(1) of the Capital Investment Code (KAGB).

-

-

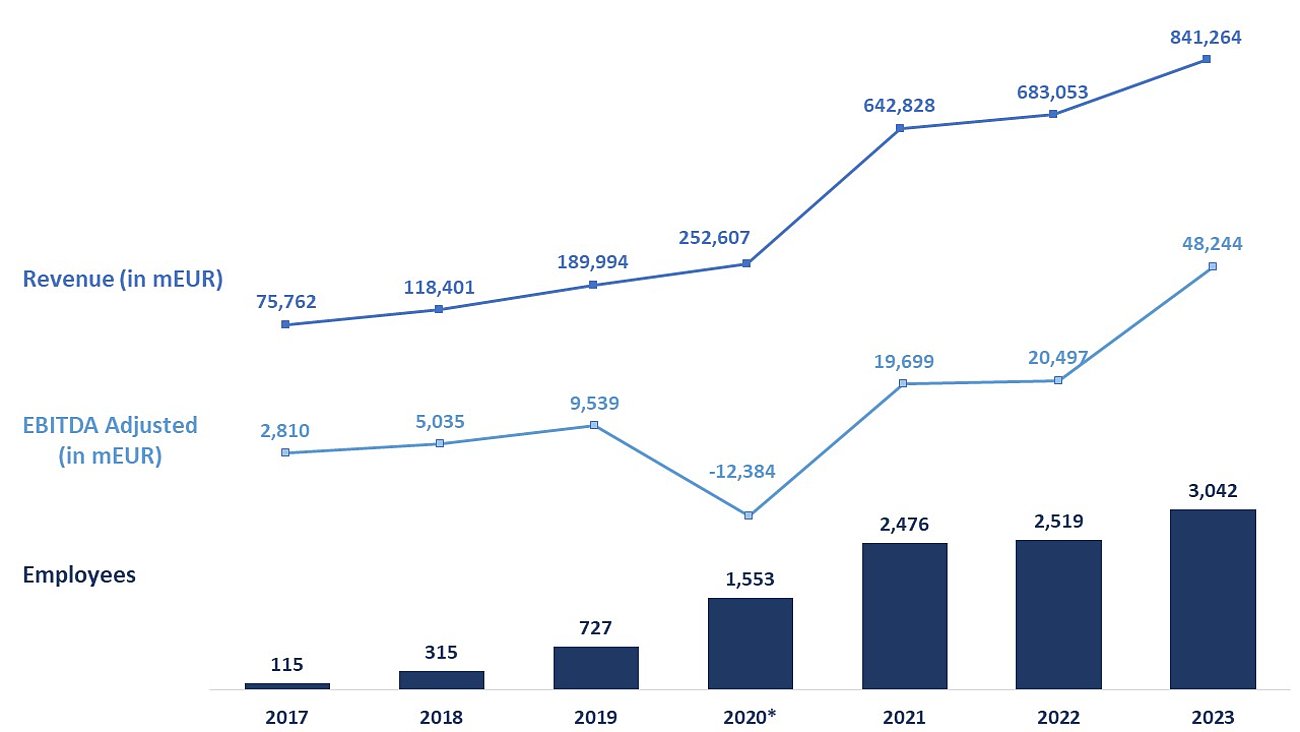

* characterized by Corona and the acquisition of Vossloh-Schwabe and its restructuring case

-

-

-

Team

Team

Working with us is highly rewarding, in both personal and financial terms. While we don’t do office politics, we do offer various and genuine opportunities for career development.

Special situations are the norm for us.

The Fidelium team has long experience in acquiring and supporting companies in special situations. Our dependability has been proven repeatedly across a wide range of transactions. We provide our partners with exceptional transaction reliability as well as the flexibility required to handle the needs of complex sales scenarios.

In recent years, the Fidelium team has successfully implemented over 30 major transactions.